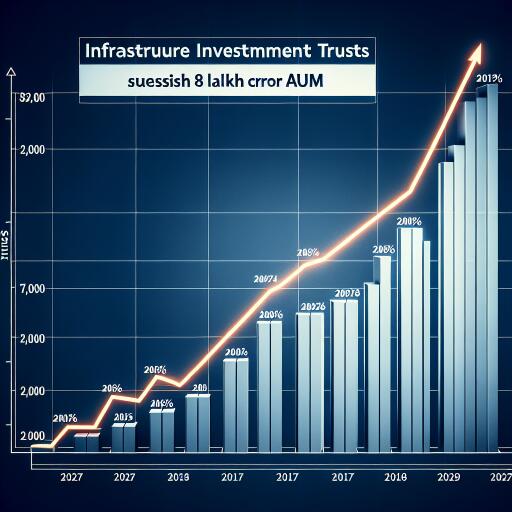

Infrastructure InvITs to Exceed Rs 8 Lakh Crore AUM by FY27: Crisil Ratings

The realm of infrastructure investment trusts (InvITs) in India is on the brink of substantial growth. According to the latest insights from Crisil Ratings, the assets under management (AUM) for InvITs are anticipated to rise significantly, exceeding Rs 8 lakh crore by the fiscal year 2027. This is a distinct climb from the Rs 6.3 lakh crore forecasted for fiscal 2025. A primary catalyst for this growth trajectory is the acquisition of assets by established trusts.

Further analysis reveals that, although this growth will likely increase leverage levels, the InvITs’ credit profiles are projected to remain stable. This stability is attributed to the superior quality of the assets, ample cash flows, and the structural advantages stemming from cash flow pooling and regulatory safeguards.

Asset addition continues to be a pivotal growth influencer for InvITs, especially considering the limited lifespan of infrastructure assets. For the current and upcoming fiscal years, AUM addition is estimated to be between Rs 1.7-1.8 lakh crore, marginally trailing the Rs 2.0 lakh crore added in the preceding two fiscal periods. Notably, the roads sector is anticipated to contribute a significant 80% of this incremental AUM, mirroring patterns observed in the prior fiscal years.

Sectors such as renewable energy, transmission, and warehousing are projected to play a role in the incremental AUM. However, their contribution may be less pronounced due to a combination of factors such as high initial leverage demands necessitating significant deleveraging under InvITs, ample access to capital outside the InvIT platforms, and a limited pool of operational assets available.

The emerging trend is that mature trusts acquiring new assets are set to make up 80-85% of the incremental AUM over the next two fiscal years, a rise from 65% in previous years. Typically, these acquisitions heighten leverage, given that the newly acquired assets often come with a higher debt quotient. For instance, InvITs with a track record spanning 2-5 years have witnessed leverage growth from 43% as of March 2023 to an expected 47% by March 2025, propelled by increased AUM due to acquisitions. With many InvITs now achieving operational maturity, they are well-positioned for growth. Consequently, overall leverage is predicted to inch up to 50% by the fiscal year 2027.

While leverage is anticipated to climb, the credit profiles are expected to stay steadfast, buoyed by stable cash flows, extended asset lifespans, and a heterogeneous asset pool. The integration of low-risk assets further bolsters InvITs’ capacity to endure higher leverage levels. For example, incorporating assets with annuity-based cash flows, such as hybrid annuity model roads into a toll road trust or power transmission assets into a renewable trust, can significantly enhance their ability to sustain elevated leverage without jeopardizing credit quality.

As leverage rises, the debt service coverage ratio (DSCR) is slightly compressed for many InvITs, moving from over 1.8x as of fiscal 2023 to approximately 1.7x. Historically, the DSCR included a buffer on account of low leverage. Despite this moderation, the current DSCR remains robust. Regulatory safeguards, like six consecutive distributions for leverage extension beyond 49% and constraints on under-construction assets, continue to uphold credit profiles.

Crucially, long-term cash flow sufficiency is pivotal in assessing credit risk. Currently, some trusts are leaning towards back-ended debt repayments buttressed by the prolonged lifespan of assets. While this strategy aids InvITs in optimizing distributions, gradual debt amortization is crucial over the medium term given the finite lifespan of assets.

In essence, while InvIT growth and credit perspectives remain stable, attentive capital structure management will be crucial as InvITs expand in size, debt levels, and complexity.

Leave a Reply